If you deal with invoices in your business, chances are you’ve encountered the terms “Net 30” and “2/10 Net 30”. But what do these phrases actually mean, and how do they affect your cash flow?

Let’s break it down

What Does Net 30 Mean?

Net 30 is a standard payment term commonly found on invoices. It signifies that payment for the goods or services received is due within 30 calendar days of the invoice date. In essence, the seller extends a short-term credit line to the buyer, the case of net 30, it’s exactly 30 days.

Strong vendor relationships are key to any successful business. Paying invoices promptly demonstrates your reliability and fosters trust, potentially leading to smoother future transactions.

How Does Net 30 Work?

Adding “Net 30” to your invoice seems simple enough, but it sets in motion a process built on trust. After issuing the invoice (with those terms clearly stated), you then wait. Ideally, your client honors the agreement and pays within the 30-day window.

Unfortunately, the real world isn’t always ideal. Late payments are a common pain point for businesses of all sizes. If 30 days pass and you’re still awaiting payment, it’s time for action. This may start with a friendly reminder but could escalate to formal demands or, in worst-case scenarios, even legal recourse to secure what you’re owed.

Let’s move on to a practical example, illustrating the exact steps of a net 30 invoice

Net 30 in Practice:

- Invoice Issued: The seller sends you an invoice marked with “Net 30” terms once goods or services are delivered. The invoice date is crucial.

- 30-Day Countdown Starts: Your 30-day payment window begins on the date of the invoice, not when you receive it in your inbox.

- Payment Deadline: You’ll need to have remitted the full payment to the seller by the 30th day to avoid being considered late.

- Potential for Early Discounts: If the invoice offers “2/10 Net 30”, you can deduct 2% from the total if you pay within the first 10 days.

- Late Payment Consequences: Paying past the Net 30 deadline could result in late fees or damage your relationship with the vendor.

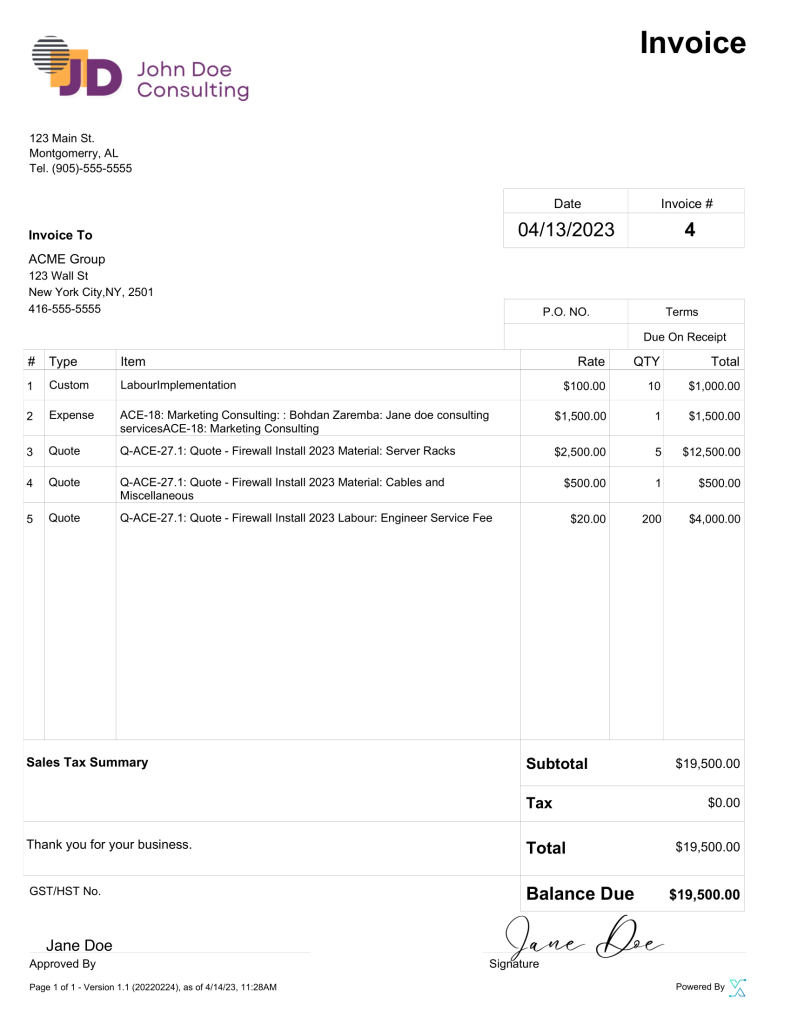

SystemX free invoice generator allows you to choose a payment term which works for you, and helps you craft a professional invoice in minutes

When does net 30 start

Net 30 payment terms begin on the day the invoice is delivered.

Let’s put it into practical terms to make sure there isn’t any confusion

Practical Example

- May 2nd: Acme Landscaping orders a load of river rock and mulch from their supplier, Bedrock Materials. Delivery is scheduled for May 5th.

- May 5th: Bedrock Materials delivers the order as promised. However, the invoice is generated and sent out on May 7th. The invoice clearly states “Net 30”.

- Net 30 Countdown Begins: Despite the goods arriving on May 5th, the Net 30 payment window starts on May 7th – the invoice date.

- Payment Due Date: Acme Landscaping has until June 6th to pay the invoice in full to avoid being considered late.

Key Takeaways:

Invoice Date is Crucial: Net 30 terms are tied to the invoice date, not when the goods or services were provided.

Even with terms like Net 30 being standard, it’s wise for the seller (Bedrock Materials in this case) to clarify those terms for their clients to avoid misunderstandings.

Advantages and disadvantages of net 30

Net 30 strikes a middle ground that benefits many sellers. It provides the buyer with reasonable time to manage their payment processes while encouraging timely payment to ensure the seller’s cash flow. This implicit trust between businesses fosters a positive long-term relationship.

Why Sellers May Hesitate

For new customers, sellers may be cautious about offering Net 30 without a track record of reliability. Similarly, startups or businesses with tight cash flow might not be able to afford the 30-day wait for incoming payment after expending resources for the goods or services.

Mitigating Risk: The Role of 2/10 Net 30

The “2/10 Net 30” discount incentivizes early payment, reducing the cash flow strain for sellers. It can also benefit the seller’s reputation, signaling reliability and building goodwill. This may lead to other preferential treatment or valuable inside information from vendors.

Key Takeaway: Net 30 isn’t a one-size-fits-all solution. Sellers must weigh its advantages against their specific business needs and the assessed reliability of their clients.

Payment Term Alternatives For Invoicing

Sellers seeking alternatives offers a few main approaches. One is to shorten the payment window with terms like Net 15 or Net 10. This improves cash flow but may be less attractive to buyers used to longer terms.

To make things simple, the number after “net” simply refers to the number of calendar days you have to pay the invoice after receiving it.

Net 7, net 30, net 60, net 90 are all in the books. It really comes down to your relationship with your client, and your business’s cash flow needs.

For maximum control, requiring payment on delivery (POD) or prepayment is an option, but it can be impractical and risks alienating clients.

The popular 2/10 Net 30 approach offers an early payment discount, encouraging faster turnaround without altering the overall payment window. However, sellers need to ensure the discount doesn’t cut into profits too deeply.

What Does 2/10 net 30 Mean

The “2/10 Net 30” notation on your invoice offers a straightforward deal: pay within 10 days of the invoice date for a 2% discount. Otherwise, the full payment is due within the standard 30 days. Sellers use this strategy to encourage prompt payment, improving their cash flow, while buyers can potentially save money by taking advantage of the discount.

2/10 net 30 in Practice

Let’s say you ordered $750 worth of equipment on the 5th of the month. The invoice arrives on the 12th with 2/10 Net 30 terms. Here’s how to take advantage of that potential discount: pay anytime between the 12th and the 22nd of the month, and you could earn a 2% savings.

The math is simple:

- Discount (2%) x Invoice Total ($750) = Savings ($15)

Pay within that window, and your total cost drops to $735. Miss those 10 days (and remember, weekends count!), and you’ll owe the original $750.

Most accounting software helps track these discounts. Integrating with an accounts payable (AP) solution like BILL can take it further, helping you stay on top of discount deadlines and managing your overall bookkeeping.

Pros and Cons

| Role | Pros | Cons |

|---|---|---|

| Buyer | Potential cost savings | Requires good cash flow management |

| Improved vendor relationships | May miss discount window | |

| Seller | Faster payments | Reduced profit margin |

| Competitive advantage | Tracking early payments |

Understanding Payment Terms for Smarter Business

Whether you’re a buyer or a seller, deciphering payment terms like is key to managing cash flow effectively. For buyers, these discounts can result in significant savings when capitalized upon, but it’s crucial to ensure prompt payment doesn’t jeopardize your own financial stability. Sellers, on the other hand, must weigh the benefits of faster payments against the slight decrease in profit margin caused by such discounts.

Ultimately, the best payment approach depends on your company’s specific needs and your relationships with clients or vendors. By understanding the nuances of these terms, you’ll empower yourself to make strategic financial decisions that support the long-term success of your business.