Introduction

Mastering the art of how to write an invoice is crucial for both entrepreneurs and freelancers. A well-structured invoice is vital in maintaining cash flow and professional relationships. This guide provides essential tips for writing an invoice that effectively communicates payment requests while showcasing professionalism.

Understanding Invoices

An invoice is a document sent to clients or customers requesting payment for services or products. It’s more than a mere formality; it represents a crucial part of business transactions.

Different types of invoices, including standard, proforma, and recurring, serve various purposes. Selecting the appropriate type is key to a smooth billing process.

Essential Components of an Invoice

- Business Information: An invoice should include the business name, contact details, and logo. This information is not just for branding but also facilitates easy communication.

- Client Information: Essential details like the client’s name and contact information ensure the invoice is directed accurately.

- Invoice Number and Date: Assigning a unique number to each invoice aids in tracking, and including the issue date is equally important.

- Item Description and Prices: Clear listing of services or products with their respective costs can prevent misunderstandings.

- Payment Terms: Outlining due dates and preferred payment methods sets clear expectations. You’ll typically s

- Total Amount Due: A transparent display of the total amount, inclusive of taxes or discounts, builds trust.

Different Types of Invoices and Their Uses

Selecting the right type of invoice is essential for an effective billing process. Here’s an overview of the common types: standard, proforma, and recurring invoices.

- Standard Invoice: The most common type, used across various industries. It details products or services, prices, and the total amount due, usually sent after delivery.

- Proforma Invoice: An estimated bill issued before delivery, commonly used in international trade. It provides a cost idea but isn’t used for actual payment requests.

- Recurring Invoice: Ideal for ongoing services like subscriptions or memberships. Sent regularly (e.g., monthly) at a fixed rate, these invoices simplify billing for repetitive transactions.

Understanding these invoice types helps businesses communicate more effectively with clients, leading to smoother transactions and consistent cash flow.

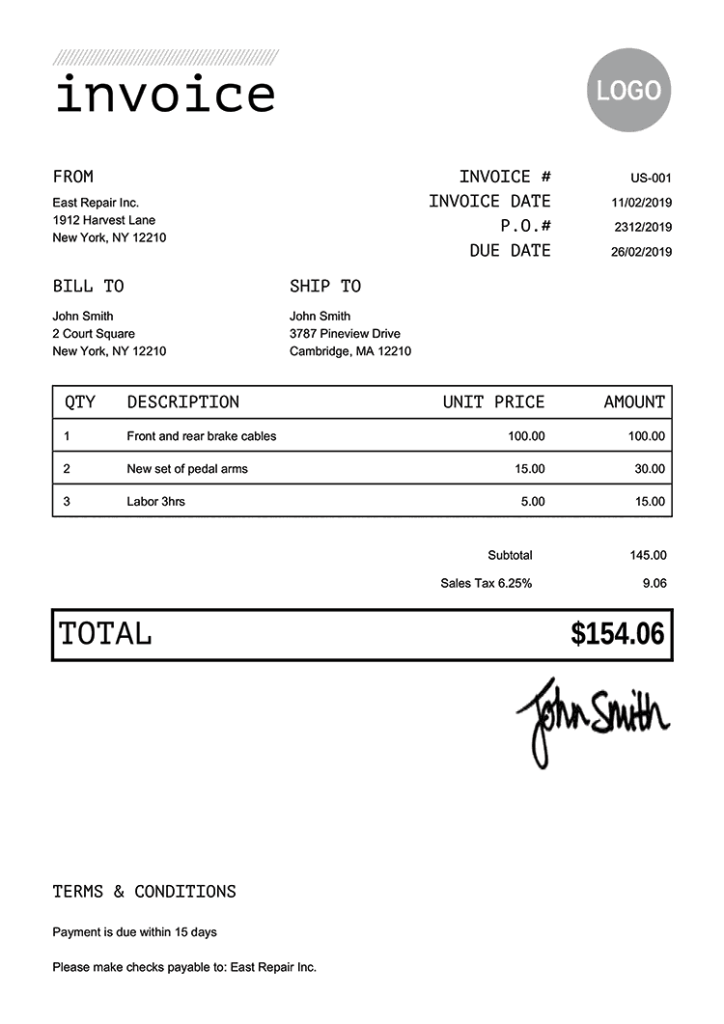

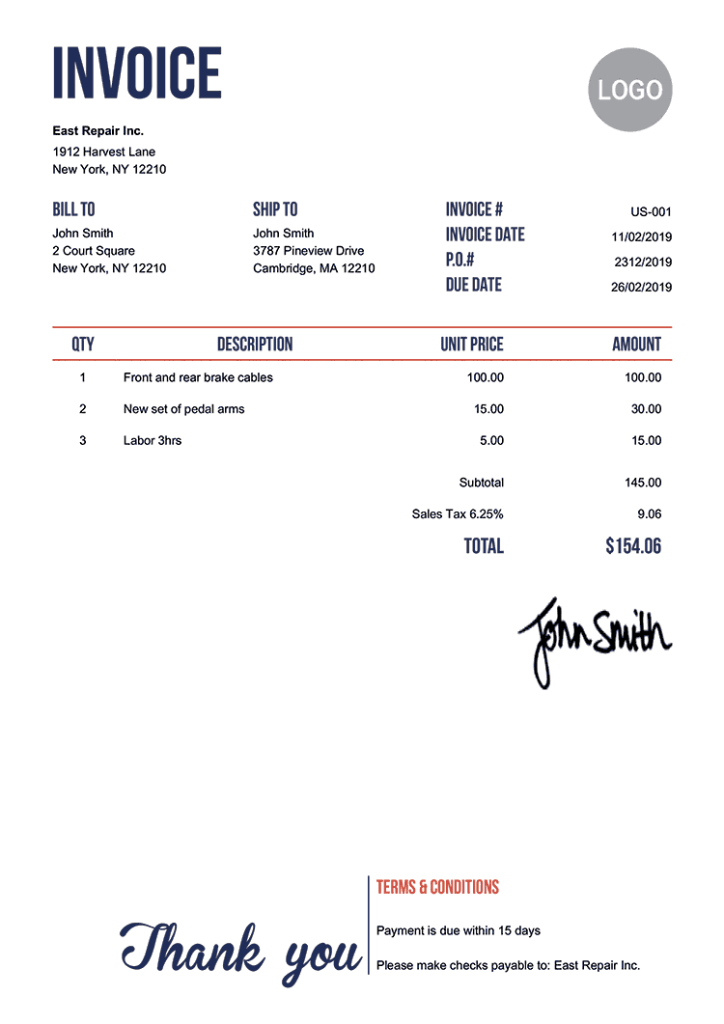

Examples of Invoices

Below are some examples of invoices, as you can see although they look different, they all contain the essential pieces of information listed above.

The Writing Process

Crafting an invoice involves more than filling out a template. Key considerations include:

- Clarity and Conciseness: Jargon should be avoided, and details should be specific.

- Professional Tone: Maintaining professionalism in the invoice can impact perceptions.

- Accuracy: Ensuring correct and error-free information is essential to avoid payment delays.

Embracing Invoicing Software

While you can always turn to free templates from programs like microsoft excel, and google sheets, modern invoicing software, such as SystemX, offers significant advantages over manual invoicing. These systems automate the invoicing process, minimizing errors and saving time. Features to look for include customizable templates, accounting software integration, and automated reminders.

If you’re struggling with making your first invoice, you can take advantage of SystemX’s free invoice generator. This tool will help you make a professional invoice in minutes.

Legal Significance of Invoices

Invoices are not merely requests for payment; they have significant legal implications. Compliance with regional tax laws and business regulations is essential. Here’s why:

- Tax Compliance: Invoices are critical for tax purposes. They must accurately reflect the amount of sales tax or VAT (Value Added Tax) charged, where applicable. Businesses must keep records of invoices to report their income correctly and calculate their tax liabilities. In some jurisdictions, failing to issue invoices or issuing incorrect invoices can lead to legal penalties.

- Proof of Transaction: An invoice serves as a legal document that proves the existence of a transaction between two parties. In case of disputes or audits, invoices can be used as evidence to clarify the details of the transaction.

- Regulatory Requirements: Depending on the industry and region, there may be specific regulatory requirements that dictate the format and information included in invoices. For instance, in some regions, invoices must include the business’s registration number, the client’s tax identification number, or specific terms and conditions.

Ethical Invoicing Practices

Ethical invoicing practices go beyond legal compliance; they are about maintaining integrity and trust in business relationships. Here are key aspects to consider:

- Timely Billing: Issuing invoices promptly is not only a best practice but also a mark of professionalism. Delayed invoicing can create cash flow problems for both the issuer and the recipient and might indicate poor business management.

- Accuracy: Ensuring that invoices are accurate in terms of quantity, descriptions, pricing, and calculations is fundamental. Accurate invoicing reflects a business’s attention to detail and commitment to fairness.

- Transparency: Invoices should be transparent and straightforward, with no hidden fees or ambiguous charges. Transparency in invoicing builds trust and reduces the likelihood of disputes.

- Confidentiality: Respecting the confidentiality of client information is crucial. This includes safeguarding the client’s financial and contact information and not sharing it without consent.

- Responsiveness: Being responsive to inquiries or disputes regarding invoices is part of ethical practice. Addressing concerns promptly and efficiently helps maintain good client relationships.

Conclusion

An effective invoice is a testament to a business’s attention to detail and professionalism. By adhering to these guidelines, businesses can create clear, accurate, and professional invoices. Utilizing tools like SystemX can simplify the invoicing process, contributing to the success of a business.

FAQ

What is an Invoice?

An invoice is a formal request for payment issued by a business to a client after delivering a product or service. It details what was provided, the amount owed, payment terms, and a due date. Invoices are crucial for record-keeping and managing cash flow in a business.

How Do You Send an Invoice?

To send an invoice, first, ensure it includes all necessary details like your business information, client’s details, services or products provided, total cost, and payment terms. Then, send it to your client, typically via email or a business management platform. Digital methods are efficient and allow for easy tracking.

Is an Invoice a Receipt?

No, an invoice is not a receipt. An invoice is sent to request payment, while a receipt is proof of payment. Once a client pays the invoice, you issue a receipt to confirm the transaction.

What Does an Invoice Look Like?

An invoice typically includes your business name and contact details, client’s information, a unique invoice number, a list of services or products provided with their prices, total amount due, payment terms, and due date. It’s usually straightforward and professional in layout.

How Do I Create an Invoice?

To create an invoice, you can use business management software or a template. Include all necessary details like your business information, client details, a breakdown of services or products, total cost, and payment terms. Software like SystemX can streamline this process with custom templates and automation features.