In the consultancy sector, handling finances well is crucial for maintaining strong professional relationships. Proper invoicing is more than just a financial necessity; it’s a way to demonstrate your reliability and commitment to clear communication.

Invoicing should be seen not just as a task but as an integral part of your consultancy service. It’s an opportunity to show you value both the professional relationship and the individual client. Opting for a clean, efficient invoice template or engaging in transparent payment discussions underscores your business’s integrity. Every invoice you send is a reflection of your business’s principles, making a significant impression on those who are integral to your success—your clients.

Choosing The Right Billing Strategy

Setting up your billing strategy is a pivotal step in defining how your consultancy operates financially. You’ll have to choose between two main models: charging by the hour or working on a retainer basis. Each has its benefits and considerations:

- Hourly Rates:

- Flexibility: Adjusts to the actual time spent on projects.

- Direct Compensation: Ensures you’re compensated for all work done.

- Consideration: May lead to fluctuating monthly earnings.

- Retainer Fees:

- Stability: Offers consistent monthly income.

- Simplified Finances: Aids in smoother cash flow planning.

- Consideration: Potential earnings could be capped during periods of increased workload.

Pro tip: Choose a payment model that aligns with what you aim to achieve in your business. Hourly rates are great for adapting to different project demands, while retainers suit those seeking steady revenue.

Understanding the difference between billable and non-billable hours is also crucial:

- Billable Hours: Time spent on activities directly related to client projects, such as conducting research or implementing strategies.

- Non-Billable Hours: Time invested in tasks not charged to clients, like marketing your services or administrative duties.

Keeping a meticulous record of both types of hours is essential for a true assessment of how your time is allocated, ensuring your business strategy is informed and intentional.

Crafting Clear Scope and Proposals

Clarifying the scope and ensuring proposal detail is fundamental to laying the foundation for a successful consultancy relationship. Before any financial engagement begins, it’s crucial to delineate the services you’ll be providing with precision. This involves specifying what will be delivered, by when, and at what cost. For example, a digital marketing consultant might outline the following:

- Scope of Services:

- Initial strategy session: 2 hours

- Delivery of marketing plan draft: within 10 days

- Completion of the first campaign setup: by the second week

This level of detail in outlining your services helps to prevent misunderstandings and sets clear expectations. Imagine a scenario where there’s a misalignment in expectations due to a lack of detailed communication—such as assuming certain services are included when they’re actually billed additionally. This could lead to client dissatisfaction or disputes over billing.

Your proposal is not just a request for payment; it’s a comprehensive document that outlines the partnership between you and your client. It should include:

- A clear statement of the client’s objectives and how you plan to meet them.

- A breakdown of the services provided, expected outcomes, and delivery timelines.

- Detailed payment terms, including rates, schedules, and any conditions.

- Provisions for confidentiality to protect both parties involved.

By integrating these elements into your proposal, you’re doing more than just setting the stage for invoicing; you’re reinforcing your commitment to value, transparency, and professionalism. This approach not only facilitates smoother financial transactions but also strengthens the trust and confidence your clients have in your services.

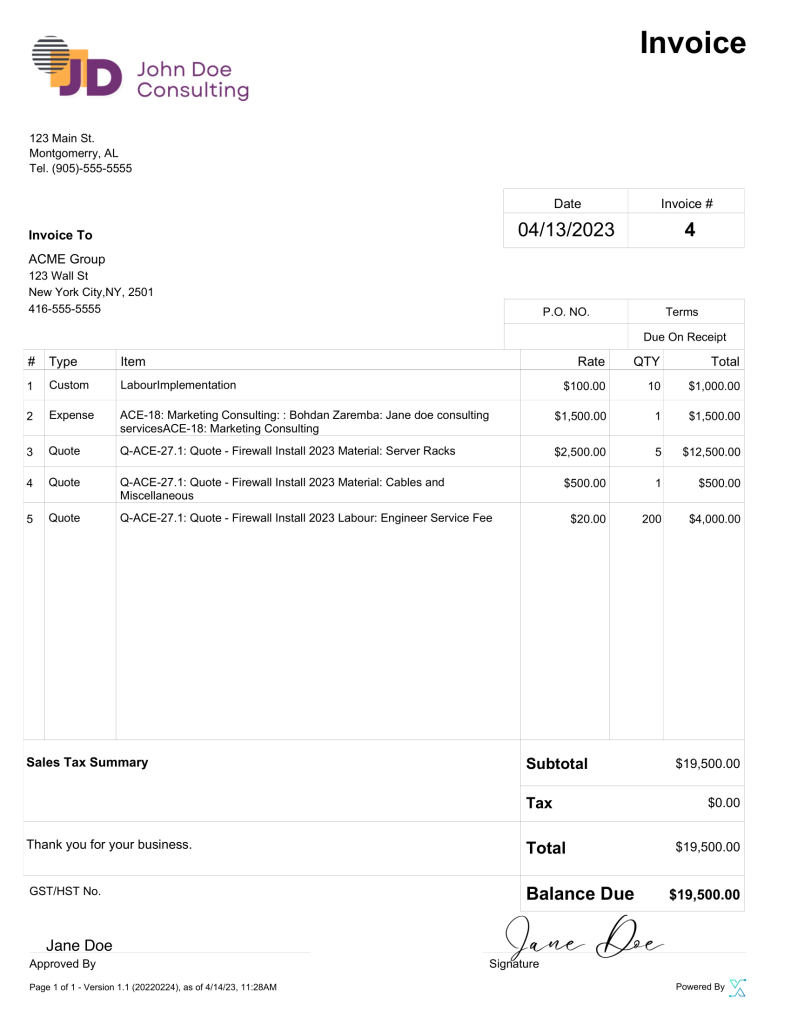

Making Your Invoice

For consultants keen on optimizing their time and maintaining a professional image, utilizing a free invoice generator like SystemX offers a practical solution. This tool simplifies the invoicing process, allowing for the creation of custom invoices that align with your business’s branding and client specifics. SystemX’s invoice generator is designed to save you time on administrative tasks, enabling you to focus more on delivering value to your clients.

By adopting such a tool, you’re not just streamlining your billing process; you’re also ensuring each invoice reflects your attention to detail and commitment to professionalism. The ability to quickly generate, send, sign, and receive payments for invoices directly through SystemX enhances the efficiency and security of your financial transactions, reinforcing the trust and confidence clients place in your services.

Elements to Include in Your Consulting Invoice

While SystemX’s invoice generator simplifies the process by walking you through key components such as the billing address and invoice number, enriching your invoice with additional elements is vital for it to truly reflect the value you deliver to your clients. This includes a detailed breakdown of services, transparent pricing, documented expenses, and customization that aligns with industry standards and enhances your brand.

Incorporating the following elements will elevate your invoice game to the next level:

- Itemized Services: Detail every service provided in an itemized format, including descriptions, the number of hours worked, and the rate charged. This might include entries like “Strategic Planning Session – 3 hours at $150/hr.”

- Pricing Details: Offer a clear breakdown of the costs for each service. For example, rather than listing “Consultancy Services,” specify “Market Research Analysis: $1,200.”

- Expenses: List any additional expenses incurred during the project. It’s important these are pre-approved by the client to avoid surprises. Examples could be “Travel Expenses: $300” or “Specialty Software Access: $100.”

- Customization: Tailor your invoice to both reflect your industry’s standards and reinforce your brand identity. For a digital marketing consultant, you might add a section that outlines achieved metrics or KPIs next to the services provided, showcasing the value of your work.

Incorporating these elements not only makes your invoices more transparent and informative but also serves as a reflection of your professionalism and the bespoke nature of your consultancy services.

Embracing Online Payment Solutions

In today’s digital age, clients expect payment processes to be straightforward and versatile. By incorporating a range of online payment methods, you cater to their preferences for convenience and flexibility. ACH transfers are particularly suitable for large transactions due to their lower fees and secure processing capabilities. On the other hand, credit card payments provide the immediate and familiar transaction experience many clients prefer for everyday dealings.

Expanding your payment options to include digital wallets such as PayPal or Stripe can also enhance client satisfaction, thanks to their user-friendly interfaces and swift transaction speeds. For international transactions, direct bank transfers offer an efficient solution, simplifying payments across borders. By offering these varied payment methods, you ensure your invoicing system meets the diverse needs and expectations of your client base, streamlining the payment process for both parties.

Establish Clear Payment Terms

Setting and communicating clear payment terms before commencing any project is essential for maintaining transparency and preventing misunderstandings later on. Begin with establishing straightforward payment conditions:

- Define Your Payment Terms: Clearly outline when and how you expect to be paid. This includes specifying billing cycles (e.g., net 30 days), accepted payment methods (such as credit cards, ACH transfers, PayPal), and any policies regarding late payments.

- Offer Payment Plans: For larger projects, consider providing payment plan options. This flexibility can make it easier for clients to manage their finances and can lead to more significant projects being approved.

- Incorporate Various Payment Solutions: Including multiple payment options can prevent disruptions in cash flow and meet clients’ diverse preferences, ultimately enhancing their satisfaction with your service.

Clear communication about these terms at the beginning of a partnership lays the groundwork for mutual trust. Discussing fees, payment schedules, and what both parties can expect upfront demonstrates your professionalism and commitment to integrity in your business dealings.

Following up on Late Payments

Addressing the issue of late payments, while potentially uncomfortable, is a necessary aspect of maintaining your business’s financial health. Establishing a clear late payment policy in your initial agreement can help manage this situation more effectively, providing a structured approach to follow if payments are delayed.

When addressing late payments, maintaining a professional tone is paramount. It’s crucial to have clear policies regarding overdue invoices and to communicate these policies early to avoid any surprises. Here’s an example of how you might craft a tactful late payment reminder:

Subject: Friendly Reminder: Invoice #12345 Overdue

Dear [Client Name],

I hope this message finds you well. I wanted to bring to your attention that payment for Invoice #12345, initially due on [Due Date], has not yet been received. We understand that oversights happen and would appreciate your prompt attention to this matter.

To ensure seamless continuation of our services, please could you kindly arrange for the payment to be processed at your earliest convenience? If there are any issues or if you have any questions regarding this invoice, please do not hesitate to get in touch.

Thank you for your prompt attention to this matter. We value your business and look forward to continuing our partnership.

Best regards,

[Your Name]

[Your Contact Information]

This example keeps the communication open and friendly while clearly stating the issue and urging prompt action. It’s also helpful to offer assistance in case there are any disputes or misunderstandings about the invoice, reinforcing a cooperative and understanding approach to resolution.

Make Your Invoicing Easy

Elevate your invoicing and give your consulting business a significant boost with SystemX. By choosing SystemX, you’re not just accessing an invoicing tool; you’re unlocking a complete client management platform that streamlines every aspect of your business operations. From customizable online invoices and integrated contract signings to simple payment processing, SystemX offers everything you need—all in one unified system.

With SystemX, the hassle of using multiple platforms becomes a thing of the past. Embrace the simplicity and efficiency of managing client relationships, cash flow, and more with ease. Discover how SystemX can transform the way you handle your consultancy’s administrative tasks, allowing you to focus more on delivering value to your clients.

Dive into SystemX today and experience firsthand how managing your consulting business can be as effortless and streamlined as ever.